In 2015 the lithium market was predominantly served by four major

suppliers. According to the United States Geological Survey an estimated

32,000 tonnes was produced from Australia (41%), Chile (36%), Argentina

(12%) and China (7%) exploiting hard rock deposits and brines

respectively. Chile and Argentina remained the top two lithium carbonate

exporters to China. Chile and Argentina exported 8,672 tonnes and 2,300

tons of lithium carbonate respectively to China, accounting for 78.46%

and 20.81% of China’s total imports.

Demand

for lithium-ion batteries increased 73 percent between 2010 and 2014,

but production only grew by 28 percent.

Source: https://about.bnef.com/blog/end-sight-near-term-lithium-supply-shortages/

The

University of Michigan estimated and summed the lithium resources in

43 deposits throughout the world to arrive at the world’s total

lithium resource of at least 39 Mt (million tonnes) in situ.

Thirty-two deposits have been estimated to contain more than 100,000

tonnes of lithium. The remaining deposits included in the total

lithium resource estimate each have less than 100,000 tonnes of

lithium but are currently producing.

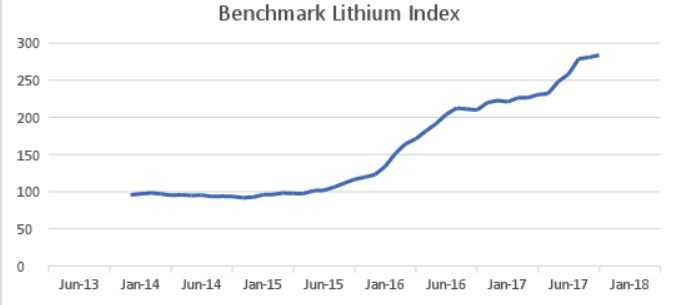

For

most of the 2000’s the lithium carbonate price steadily increased,

however over the past 12 months the price has dramatically increased

from US$7,000 to US$22,000 per tonne leading to a new boom in project

acquisitions across the world as companies scramble to secure tenure

across land prospective for pegmatites. In 1998 to 2009 the average

price for lithium carbonate per tonne grew to more than three times

its historical benchmark of US$2,000 per tonne, peaking at around

US$6,000 per tonne by the end of 2012. After the peak, in 2013

industry undertook an adjusting period of 10 months through to

October 2014 where new demand from energy vehicles increased the

price for lithium carbonate and started a new rally in the latter

half of 2014. The 2015 rally corresponded to a combination of two

factors being the demand for battery grade lithium carbonate caused

by a demand for new energy vehicles and upstream industry bottleneck

issues. Prices increased to US$8,000 per tonne. As of July, 2016,

battery grade lithium carbonate has reached to more than US$22,000

per tonne LCE. In 2015 the price for lithium carbonate rose by 150%.

In the first quarter of 2016 the industrial grade lithium carbonate

prices rose to more than US$7,000 per tonne with battery grade

reported to be around US$7,800 per tonne, an increase of about 20%

from the 2014 price.

Benchmark Mineral

Intelligence estimates prices of lithium carbonate will average

$13,000 a tonne over the 2017-2020 period from around $9,000 a ton in

2015-2016. Demand for lithium hydroxide, preferred over carbonate as

it allows greater battery capacity and longer life, is expected to

grow at a faster pace. Benchmark predicts the price to average

$18,000 a tonne between 2017-2020 against $14,000 in 2015-2016. In

2016, worldwide lithium spot price increased 40-60% year over year

and large, fixed contract prices of lithium carbonate rose 14%,

although in China spot lithium carbonate prices at one point of time

shot up 300%, briefly exceeding $20,000/ton, due to a temporary

shortage of imported spodumene from Australia. The London Metal

Exchange is looking into introducing a contract for lithium.