Lithium minerals and compounds

Spodumene – LiAlSi2O6.

Spodumene is a monoclinic pyroxene with a density of 3.16. It is the most important lithium ore mineral because of its high lithium content, extensive deposits and easy processing.

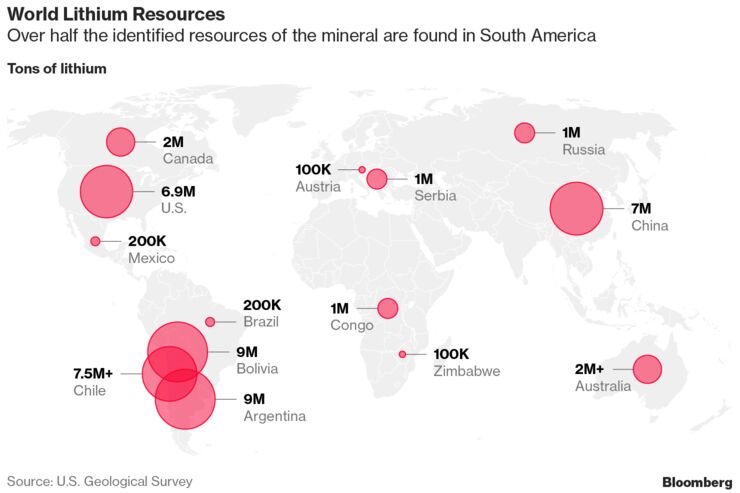

The Lithium Triangle iis located on the borders where Chile, Bolivia and Argentina meet. Bounded by the Salar de Atacama, Salar de Uyuni and Salar del Humbre Muerto, the Lithium Triangle also takes in the northern ends of Chile and Argentina. Over 70% of the World’s economic lithium deposits are found in this one small location on Earth. As a result, these three countries dominate world lithium supplies thanks to the tectonic forces that shaped the South American continent. Geological subduction of the Pacific tectonic plate under the Chilean coast, together with the resulting tectonic uplift of South America, created large localised depressions which cause water to collect into lakes, instead of flowing into the sea. The lithium salts that dissolve out of the surrounding rocks gather in these great lakes.

Petalite - LiAl(Si4O10)

Lithium Conversion Table

To convert from:

|

to Li

X |

to Li2O

x |

to Li2CO3

x |

|---|---|---|---|

Lithium

Li (100% Li) |

2.153

|

5.323

|

|

Lithium oxide Lithio (6.4% Li)

|

0.464

|

1.000

|

2.473

|

Lithium bromide

LiBr (8.0% Li) |

0.080

|

0.172

|

0.425

|

Lithium carbonate

Li2CO3 (18.8% Li) |

0.188

|

0.404

|

1.000

|

Lithium hydroxide monohydrate

LiOH.H2O (16.5% Li) |

0.165

|

0.356

|

0.880

|

Lithium chloride

LiCl (16.3% Li) |

0.163

|

0.362

|

0.871

|

Lithium fluoride

LiF (26.8% Li) |

0.268

|

0.576

|

1.420

|

Lithium hypochlorite

LiOCl (11.89% Li) |

0.119

|

0.256

|

0.633

|

Butyllithium

C4H9Li (10.83% Li) |

0.108

|

0.233

|

0.576

|

Deposits

The Lithium Triangle iis located on the borders where Chile, Bolivia and Argentina meet. Bounded by the Salar de Atacama, Salar de Uyuni and Salar del Humbre Muerto, the Lithium Triangle also takes in the northern ends of Chile and Argentina. Over 70% of the World’s economic lithium deposits are found in this one small location on Earth. As a result, these three countries dominate world lithium supplies thanks to the tectonic forces that shaped the South American continent. Geological subduction of the Pacific tectonic plate under the Chilean coast, together with the resulting tectonic uplift of South America, created large localised depressions which cause water to collect into lakes, instead of flowing into the sea. The lithium salts that dissolve out of the surrounding rocks gather in these great lakes.

Data Comparison of South American Salares in the Lithium Triangle

Bolivia

|

Chile

|

Argentina

|

|

|---|---|---|---|

Salar Name

|

Uyuni

|

Atacama

|

Hombre Muerto

|

Altitude (km)

|

3.7

|

2.3

|

4.3

|

Area (km 2)

|

8,000

|

3,000

|

570

|

Li Concentration (%/wt)

|

0.0350

|

0.1500

|

0.0620

|

Mg/Li Ratio

|

18.6

|

6.4

|

1.4

|

Evaporation (mm/year)

|

1,500

|

3,200

|

2,300

|

Companies active in the Lithium Triangle

Salar de Pozuelos, Salars Pastos Grandes, Salinas Grandes, Rio Grande, Jama (LSC Lithium and Lithea Argentine, Korean)

Salar Pocitos (Pure Energy, Southern Lithium, Great Thunder, Argosy Minerals)

Salar Mina Teresa ( Argosy Minerals)

Salar Mina Teresa ( Argosy Minerals)

Salar de Aguas Calientes, Salar de Pujsa, Salar de Quisquiro (Wealth Minerals, Canadian)

Salar Mariana (International Lithium)

Salar Maricunga (Bearing Lithium)

Salar Mariana (International Lithium)

Salar Maricunga (Bearing Lithium)

Bolivia’s Salar de Uyuni is the world’s largest potential source of lithium, although it is not currently producing. Uyuni has a total surface area of 9,000 to 10,500 km2 and contains a layer of halite with interstitial brine that is enriched in lithium, potassium, magnesium, and boron. Concentrations of lithium in this brine are reported in the literature range from 80 ppm to 4,700 ppm. COMIBOL has drilled two test holes, which identified 11 salt-brine layers separated by clay layers totalling 170 meters in thickness. Further evaluation is needed to determine the extent of these separate horizons that could produce lithium economically. A pilot mining and processing project was started in May 2008. Recent estimates for Uyuni’s lithium resources range from 0.6 to 9.0 Mt. Tahil’s estimate is the most conservative, at 0.6 Mt, whereas estimates by Anstett el al, Garrett, Clarke and Harben, Yaksic and Tilton,and Evans (2008), are between 5 and 5.5Mt. Evans (2009) and Risacher and Fritz round out the top end of the range, at 8.9 to 9 Mt.

President Evo Morales said in October 2017 that Bolivia will invest as much as $200 million to develop the Andean nation's lithium deposits and that La Paz would welcome private partners in the effort as long as they accept the government's claim to 60 percent of the revenues. At a news conference with international media, Morales referred to expressions of interest from Japan's Mitsubishi and Sumitomo, South Korean conglomerate LG and France's Bollore.

President Evo Morales said in October 2017 that Bolivia will invest as much as $200 million to develop the Andean nation's lithium deposits and that La Paz would welcome private partners in the effort as long as they accept the government's claim to 60 percent of the revenues. At a news conference with international media, Morales referred to expressions of interest from Japan's Mitsubishi and Sumitomo, South Korean conglomerate LG and France's Bollore.

Average Li concentration map of Uyuni (g/L), average concentrations below 0.03% circled in red (adapted from Risacher and Fritz 1991).

The Salar de Atacama, in northern Chile, is a 3,000 km2 desert salt basin and the world’s largest producer of lithium. Two companies, Sociedad Quimica y Minera (SQM) and Rockwood Holdings, Inc., extract lithium from this brine. SQM has a claim of ~820 km2 and two operations in the nucleus. It currently produces lithium from its south-western operation. Rockwood has a claim of ~137 km2 and one operation in the south-east, part of which is devoted to lithium extraction. A buffer zone of around 100 km2 separates the two companies’ claims. It contains a total lithium resource of about 6.3 Mt.

The Salar del Hombre Muerto is a 565 km2 playa in Argentina with a 280 km2 salt nucleus in its south-east section. The salar contains brines with concentrations ranging from 190 to 900 ppm lithium. Compared to Atacama and Uyuni, Hombre Muerto has lower concentrations of lithium but also very low levels of magnesium, which in high concentrations can cause problems in processing of brines to extract lithium.

Li brine analysis (g/L) across the Salar del Hombre Muerto; concentrations below 0.03% Li are in red (adapted from Risacher and Fritz 1991).

FMC Corporation obtained the rights to Hombre Muerto from the Argentine government in 1995. Production in 2008 was estimated at 3,115 tonnes of lithium metal, or 10,000 tonnes of lithium carbonate and 7,600 tonnes of lithium chloride. Recent estimates for Hombre Muerto’s lithium reserves range from 0.4 to 0.850 Mt.

Potash (KCl) is an important by product in the recovery of lithium from these brines

Potash (KCl) is an important by product in the recovery of lithium from these brines

Project (Salar) and Potassium (mg/L) Company

Mariana (Llullaillaco).....9400 to 11300 International Lithium Corp

Salinas Grande.................9547 Orocobre Limited

Sal de Vida ........................8051 to 8653 Lithium One Inc

Rincon ................................8070 Sentient Group

Diablillos............................6206 Rodinia Lithium Inc

Olaroz ................................5730 Orocobre Limited

Olaroz-Cauchari ...........4900 to 5900 Lithium Americas Corp(and SQM)

Global distribution of closed basin potash-bearing brine deposits

Albemarle

Corporation

(NYSE:ALB),

an

American industrial company producing lithium chemicals acquired

Rockwood Lithium which previously merged with Talison Lithium. It

has lithium resources in the Salar

de Atacama,

Chile; Silver

Peak,

NV, USA; Greenbushes,

Australia. In 2014 Albermarle Corp. agreed to pay $6.2 billion in

cash and stock for Rockwood Holdings Inc. which included the Clayton

Valley, Rockwood Lithium mine. The Silver Peak area is one of the

oldest mining areas in Nevada as this area produced substantial

amounts of silver, gold and other minerals. In 1967 the Rockwood

Lithium mine began operations to mine lithium by method of low cost

evaporation ponds and has produced lithium since then. This general

area is surrounded by lithium-enriched tertiary rhyolite tuffs and

lithium-bearing sediments, as well as active geothermal systems.

Over time, the lithium has become mobilized from these sources and

deposited into the ground water. In 2010 the Rockwood Lithium mine

received a $28.4 million grant from the U.S. Department of Energy to

expand and upgrade the production for battery grade usage. It is

estimated that since initial production began the Rockwood Lithium

mine produced over 150,000 tons of lithium and in ground reserve

estimates of 382,000 tons of lithium. Australia’s largest lithium

mine, Greenbushes, is majority controlled by China’s Tianqi

Group.

Tianqi owns a 51-percent stake in Talison Lithium, which runs the

mine, while Albemarle now owns a 49-percent stake in the company via

its acquisition of Rockwood. Talison Lithium also has a lithium

brine project located in the Atacama Region III, in Chile. This

prospective exploration project consists of seven salars (brine

lakes and surrounding concessions). Five of the salars are

clustered within a radius of approximately 30kms and are 100% owned

by Talison Lithium and its Chilean partners. Tianqi

Lithium Industries Inc.

(SHE:002466)

also bought 2.1 per cent of Sociedad Quimica y Minera de Chile

(ADR)(NYSE:SQM)

for $38 a share — more than a 50 per cent premium to the company’s

share price. Tianqi is a direct competitor to SQM, and establishing

a foothold in the company’s shares might be a precursor to the

Chinese entity’s drive to gain control over Chile’s No. 1

lithium producer. Paying such a high premium over market suggests

there is a great deal of strategic value to Tianqi in the

acquisition. Tianqi Group HK Co., Limited is based in Hong Kong.

Tianqi Group HK Co., Limited operates as a subsidiary of Chengdu

Tianqi Industry Group Co., Ltd. Albemarle is planning to expand its

lithium carbonate equivalent capacity to 165,000 tonnes by 2021 from

89,000 tonnes in 2017. Albemarle

Corporation

has developed a novel technology that would allow it to increase

annual lithium production in Chile on a sustainable basis to as much

as 125,000 metric tons of lithium carbonate equivalent without

requiring additional brine pumping at its facility in the Salar de

Atacama. The move is part of the company’s efforts to beef up

efficiencies and sustainability of its Atacama operations. As a

result, Albemarle has asked the Chilean Economic Development Agency,

Corfo to increase its lithium production quota. Albemarle noted that

it intends to construct and start-up additional lithium carbonate

capacity in Chile in the early 2020s once the present expansion

projects are completed and operate at full capacity. Projects

currently underway are expected to raise the company’s total

annual production capacity in Chile to more than 80,000 metric tons

of lithium carbonate equivalent by 2020. Albemarle has been

expanding production to help keep up with rising lithium demand: In

early 2017, it announced that it received approval from the Chilean

authorities to extract enough lithium to increase its annual Chilean

battery-grade lithium carbonate production from 70,000 metric tons

(MT) to 90,000 MT over the next four years. This modest increase

came on the heels of a huge increase, as in early 2016, it received

approval to hike this number from 24,000 MT to 70,000 MT. In March

2017, it announced an expansion at its joint venture in Greenbushes

that will more than double that operation's lithium carbonate

equivalent (LCE) production capacity from 80,000 MT per year to more

than 160,000 MT per year. Albemarle has a 50% interest in what's

produced at this JV. This expansion is slated to begin in Q2 of

2019. Albemarle could also have a potentially very promising new

lithium source coming on line in the future. In the fall of 2016, it

announced an agreement with Bolland Minera S.A. for the exclusive

exploration-and-acquisition rights to a lithium resource in

Antofalla,

within the Catamarca Province of Argentina. Albemarle said at the

time that it believed this resource would be certified as the

largest lithium resource in Argentina.

Alix Resources Corporation (AIX-TSX:V) is a Canadian exploration company with five lithium projects in Canada, the USA and Mexico. The Electra Project consists of two exploration properties in Sonora, Mexico, contiguous to Bacanora Minerals' Sonora Lithium Project. Alix's concessions target interpreted extensions of lithium-bearing clays extending from Bacanora Minerals' Sonora Lithium property. The White Basin property is located roughly 75 kilometres north-east of Las Vegas. Sampling on the property has returned values as high as 3,762ppm Li from six composite samples of the Horse Spring Formation. The Horse Spring Formation is Oligocene-Miocene in age and includes clay-rich, altered volcanic units with historic reports of elevated lithium. On May 1, 2017 Alix and partner Lithium Australia (ASX:LIT) announced preliminary results of metallurgical tests for the recovery of lithium from volcanogenic sediments at the Agua Fria prospect, part of the larger Electra project. Simple four hour, sulphuric acid leach tests, carried out at “room temperature” extracted up to 85% of the contained lithium. A very modest increase in temperature to only 50o C has achieved lithium extractions of 94-99% in only 4 hours. The Preissac-Lacorne lithium properties contain numerous showings mineralized in Li (spodumene) ±Ta (tantalite) ±Be (beryl), and have been investigated sporadically by junior mining companies with various geophysical, geochemical and geological tools from the early 1950's until the present day. The Cross Lake property covers the Cross Lake pegmatite field, including the Liz Lithium prospect, located on Spodumene and Metis Islands in the south-western corner of Cross Lake. The granitic pegmatites form an 8 km-long, en echelon and lenticular swarm south of Cross Island dipping 45° north. The Jackpot lithium property, is located in the Georgia Lake Area about 140 km NNE of Thunder Bay, Ontario. The property has a historical resource on the Dyke No. 2 pegmatite zone, reported as 2Mt @ 1.09 LiO estimated in 1956 by Ontario Lithium Company Limited. The No. 2 pegmatite dyke, which was discovered by diamond-drilling, was intersected at intervals of 30 to 100 meters over a strike length of 215 meters and at intervals of 30-60 meters over a distance of 365 meters across strike. Dyke No. 2 is 4 to 20 meters thick, averaging 11 meters.

Consultants Roskill estimates FMC, Albemarle, SQM and China's Tianqi Lithium Corporation together accounted for 66 percent of the world's lithium carbonate equivalent in 2016.

Producing deposits with less than 100,000 tonnes Li. (Clarke and Harben 2009; Yaksic and Tilton 2009)

Deposit

|

Country

|

Type

|

Li Resource (tonnes)

|

2008 Production

(tonnes Li)

|

Lijiagou

|

China

|

Pegmatite

|

53,000

|

NA

|

Hupei

|

China

|

Pegmatite

|

42,000

|

NA

|

Cachoeira

|

Brazil

|

Pegmatite

|

23,000

|

14

|

Bernic Lake

|

Canada

|

Pegmatite

|

19,000

|

300

|

Mesquitila/Guarda

|

Portugal

|

Pegmatite

|

10,000

|

110

|

Ningdu

|

China

|

Pegmatite

|

NA

|

NA

|

Jinchuan

|

China

|

Pegmatite

|

NA

|

NA

|

Mina Feli

|

Spain

|

Pegmatite

|

NA

|

NA

|

Total:

|

147,000

|

424

|

Advantage

Lithium

(TSX-V:AAL),

is a Canadian based lithium explorer with projects in Argentina,

Mexico

and

Nevada.

The Company has a partnership with Orocobre

- one of Argentina’s leading lithium producers - to develop its

Cauchari

asset, which hosts an inferred resource of 230 million cubic metres

of brine at 380 mg/l Lithium and 3,700 mg/l potassium and includes a

large exploration target. Orocobre

is the largest single shareholder of Advantage Lithium. Samples

collected during a preliminary pump test returned an average Li grade

of 678 mg/l. Advantage received assay results from the preliminary

pumping test on a well installed in the SE sector of the Cauchari JV.

This well was installed with filter sections between 50 and 340

metres. Results have returned an average lithium grade of 682

milligrams per liter (mg/l) over the period of 48 hours, consistent

with the initial average of 678 mg/l over the first 6 hours of this

test. This is positive as it confirms lithium grades have been

maintained throughout the pumping test, with an excellent Mg/Li ratio

averaging 2.2/1 over the 48 hour test period. This lithium

concentration and Mg/Li ratio are directly comparable to that defined

during exploration at the now producing Olaroz project, 20 km to the

north of the Cauchari JV (refer to the NI43-101 Technical Report on

the Salar de Olaroz Lithium Potash Project by Houston and Gunn, May

13, 2011). Systematic double-packer sampling of individual filter

sections will proceed shortly over the total 340m depth of the

developed well. Advantage Lithium has also drilled lithium brines on

all six of its drill holes at Clayton

NE,

Nevada - situated adjacent to Albemarle’s Silver Peak operation.

The company intersected

lithium brine with the first borehole and proved the existence of

up to 218 ppm lithium. A second drill hole intersected 387.69 m with

243.66 mg/l, including several sections with higher grade material.

Another drill hole intersected 426.72 m with 243.44 mg/l lithium,

including a higher-grade section with 274.6 mg/l over 79.2 m. The

Jackson

Wash Project

is situated 30 km south east of Clayton Valley, is an independent

brine basin and analogous in sedimentary formations and underlying

structures to Clayton Valley basin. To date these formations were not

drill tested but in 2011 several soil samples were taken containing

up to 117 ppm lithium. The Neptune

Project is

situated south west of

Lithium X’s

properties. One of the two holes drilled by Nevada Sunrise

encountered grades averaging 156 ppm Li2O

over 65.5 m. In September 2016 Advantage Lithium entered into a

letter of intent with Radius Gold Inc. for an option to acquire up to

a 70% interest in four

lithium brine projects located in Chihuahua and Coahuila,

Mexico.

The four projects, covering a total of approximately 37,000 hectares,

are located in large, salar closed basins, in geological settings

analogous to the Clayton Valley. Historic exploration work in two of

the project areas has already detected lithium grades of 283 ppm (La

Union) and 189 ppm (La Viesca). In October 2016 Advantage Lithium

announced the acquisition of a 100% interest in the Stella

Marys project, Argentina.

Stella Marys lies immediately adjacent to Orocobre’s Salar

de Salinas Grandes

lithium-potassium-boron brine project, which hosts a near-surface,

low sulphate inferred resource estimate of 56.5 million cubic meters

of brine averaging 795 mg/l lithium (for 239,200 tons LCE, (Lithium

Carbonate Equivalent) and 9,547 mg/l potassium and 283 mg/l boron.

Orocobre’s shallow inferred mineral resource is immediately

adjacent to and potentially extends onto the Stella Marys Project.

ADY

Resources Limited,

owned by Toronto’s Enirgi

Group Corporation, operates in

the Argentine province of

Salta, a few kilometres from

the Chilean border. ADY has ownership interests in a number of

salars in the Argentine Puna and is developing a major lithium brine

resource at its wholly owned

Salar del Rincon located in

Salta province. It has 20 evaporation ponds to process the lithium

salts. By 2017, ADY Resources plans to build a factory capable of

producing 25,000 tonnes per year, which would make it one of the

world’s leading producers. ADY Resources Limited is a former

subsidiary of Admiralty Resources NL.

Salar

del Rincon

Alix Resources Corporation (AIX-TSX:V) is a Canadian exploration company with five lithium projects in Canada, the USA and Mexico. The Electra Project consists of two exploration properties in Sonora, Mexico, contiguous to Bacanora Minerals' Sonora Lithium Project. Alix's concessions target interpreted extensions of lithium-bearing clays extending from Bacanora Minerals' Sonora Lithium property. The White Basin property is located roughly 75 kilometres north-east of Las Vegas. Sampling on the property has returned values as high as 3,762ppm Li from six composite samples of the Horse Spring Formation. The Horse Spring Formation is Oligocene-Miocene in age and includes clay-rich, altered volcanic units with historic reports of elevated lithium. On May 1, 2017 Alix and partner Lithium Australia (ASX:LIT) announced preliminary results of metallurgical tests for the recovery of lithium from volcanogenic sediments at the Agua Fria prospect, part of the larger Electra project. Simple four hour, sulphuric acid leach tests, carried out at “room temperature” extracted up to 85% of the contained lithium. A very modest increase in temperature to only 50o C has achieved lithium extractions of 94-99% in only 4 hours. The Preissac-Lacorne lithium properties contain numerous showings mineralized in Li (spodumene) ±Ta (tantalite) ±Be (beryl), and have been investigated sporadically by junior mining companies with various geophysical, geochemical and geological tools from the early 1950's until the present day. The Cross Lake property covers the Cross Lake pegmatite field, including the Liz Lithium prospect, located on Spodumene and Metis Islands in the south-western corner of Cross Lake. The granitic pegmatites form an 8 km-long, en echelon and lenticular swarm south of Cross Island dipping 45° north. The Jackpot lithium property, is located in the Georgia Lake Area about 140 km NNE of Thunder Bay, Ontario. The property has a historical resource on the Dyke No. 2 pegmatite zone, reported as 2Mt @ 1.09 LiO estimated in 1956 by Ontario Lithium Company Limited. The No. 2 pegmatite dyke, which was discovered by diamond-drilling, was intersected at intervals of 30 to 100 meters over a strike length of 215 meters and at intervals of 30-60 meters over a distance of 365 meters across strike. Dyke No. 2 is 4 to 20 meters thick, averaging 11 meters.

Alset

Minerals Corporation

(TSXV:

ION)

is

a Canadian resource

explorer that is focused on discovering and developing high grade

lithium deposits. The company’s main project is in central Mexico,

where it currently has a 100% interest in seven salars containing

high-grade lithium and potassium. These salars are in the states of

Zacatecas and San Luis Potosi. In total, the seven salars cover an

area of approximately 3,480 hectares (8,600 acres).Alset

Minerals reported further results on 2 October 2017 from sampling of

the Company’s 100% owned salars located in the states of Zacatecas

and San Luis Potosi, Mexico. All of these salars returned positive

lithium and potassium results. Upon completing the drilling at the

La Salada salar, a reconnaissance auger sampling program was

initiated on 13 additional salars to investigate mineralization of

soils in the first 1 metre layer. The Company is very encouraged by

the results with all the salars being mineralized including some

with very promising grades of lithium and potassium. Of the 13

salars sampled, 9 had average lithium grades exceeding 200ppm, with

4 salars averaging lithium grades of around 400ppm and higher. Santa

Clara, the largest salar, had an average lithium grade of 392ppm

with a high of 890ppm. At Chapala salar, lithium grades reached a

high of 530ppm with an average of 416ppm. Hernandez salar returned a

high of 670ppm and average of 556ppm. The highest maximum and

average lithium grades came from the Caliguey salar with a high of

1820ppm and an average of 769ppm. Sampling also returned encouraging

results for potassium (K). The average potassium grade for all 13

salars range from 1.20% to 3.38% K, with 9 of the salars exceeding

an average grade of 2.00% K. At Caliguey, Santa Clara and El

Salitral the average grade exceeded 3.38% K. Caliguey returned a

maximum grade of 5.29% K, with an average grade of 3.38% K. Santa

Clara, returned a maximum grade of 4.60% K. El Salitral returned a

maximum grade of 4.28% K and an average grade of 3.78% K.

Altura

Mining Ltd (AJM:AU)

is

developing the

Wodgina Project

in Western Australia. JORC Mineral Resource estimate of 25.157 Mt of

mineralised spodumene pegmatites at 1.23% Li2O

(containing 310,000 tonnes of lithium oxide). The estimate comprises

an Indicated Resource of 17.288 Mt @ 1.25% Li2O

and an Inferred Resource of 7.869 Mt @ 1.20% Li2O.

In Q2 2016, Altura signed a Binding oftake Agreement with China

based group Lionergy

Limited.

On

22 February 2016, settlement of the share placement with Lionergy

Limited took place. Altura received the A$3 million and these

additional funds will primarily be directed towards the development

of Altura’s 100% owned Pilgangoora

Lithium project,

including completion of the Feasibility Study scheduled for

completion by the end of March 2016.

American Lithium Corp. (LI:CN) is actively engaged in the acquisition, exploration and development of lithium deposits within mining-friendly jurisdictions throughout the Americas. American Lithium holds options to acquire Nevada lithium brine claims totalling 20,790 acres (8,413 hectares), including 18,552 acres (7,508 hectares) in Fish Lake Valley, Esmeralda County, and the 2,240 acre (907 hectare) San Emidio Project in Washoe County. The Company’s Fish Lake Valley lithium brine properties are located approximately 38 kilometers from Albemarle's Silver Peak, the largest lithium operation in the U.S. The highest grouping of assay values, 55 samples from the center of the North Playa, contains concentrations averaging 160 mg/L and a range of 100 ml/L to 300 mg/L

American Lithium Minerals, Inc. (AMLM) is an exploration-stage company. It is focused on the development of lithium and boron resources in Nevada. American Lithium has three lithium brine projects in the >Great Basin of Nevada>. The projects are located in the basins of Sarcobatus Deep, >Teels Marsh Deep and Fish Lake Deep>. The Company’s primary asset is the >Borate Hills >property in western Nevada, which covers an area of over 3,400 acres. The Borate Hills property features a deposit of 2750 parts per million of lithium (0.275%) and 1% boron. On January 5, 2010, the Company entered into an agreement with Gold Summit Corporation to acquire a 100% interest in five grass roots exploration brine projects mineral claims located in Nevada, the United States. On January 11, 2010, it entered into a property acquisition agreement to acquire a 100% interest in mineral claims located in Nevada, the United States, and to acquire a 100% interest in mineral claims located in Utah. On June 10, 2010, the Company entered into a property option agreement with >Japan Oil, Gas and Metals National Corporation (JOGMEC), whereby JOGMEC can earn a 40% participating interest in certain mineral claims located in Nevada, which is owned by the Company. In 2012 American Lithium Minerals Inc. entered into a binding Letter of Intent with Trivest Pty. Ltd. for the purchase by Trivest of 100% of their 60% interest in the North and South Borate Hills Property. American Lithium’s interest in the property was subject to a Memorandum of Understanding dated June 10, 2010 with Japan Oil, Gas and Metals National Corporation whereby Japan Oil may earn a 40% participating interest in the property for $4,000,000 cash or in kind contribution to be invested directly in the North and South Borate Project through 2013.

American Potash Corporation (APCOF) have been exploring for and developing Lithium and Potash resources in the Paradox Basin, SE Utah (UT) and SW Colorado (CO), USA for over eight years. Total Lithium + Potash exploration/development rights holdings in UT and CO of approximately 52,160 acres. American Potash control large Potash and Lithium exploration/development rights holdings covering over 40,000 combined acres in Utah Paradox Basin, SE UT. American Potash is the only explorer in the Paradox Basin with significant exploration and development rights to both Potash (K) and Lithium (Li), with about 13,200 acres of overlapping Lithium + Potash + Bromine (Br) rights in UT. American Potash recently (March, 2017) acquired 608 Federal Lithium (+ Br) placer claims covering 12,160 acres in the Colorado Paradox Basin, SW CO.

AMG (Advanced Metallurgical Group NV) (AMG:NA) is entering the lithium market with an investment of approximately $50 million in the construction of a lithium concentrate (also known as spodumene) plant at its existing Mibra mine in Brazil. Leveraging its existing mining infrastructure in place at Mibra (which has been in operation for almost 40 years), AMG’s goal is to be the low-cost producer of lithium concentrate globally. AMG can recover lithium-bearing materials from the existing and future tailings at its profitable tantalum operations at Mibra, with the ore extraction and crushing costs absorbed by the yantalum operations. AMG has successfully operated a lithium pilot plant since 2010, with more than 2.8 million tons of spodumene feed stock having been extracted. AMG has successfully operated a lithium pilot plant since 2010, with more than 2.8 million tons of spodumene feed stock having been extracted. Phase I of the project involves the construction of a lithium concentrate plant to produce 90,000 MT of spodumene per year, with operations expected to commence in the first half of 2018. Phase II would entail increasing the annual production of spodumene from 90,000 MT to 180,000 MT per year. Phase 3 of the project would see AMG expand its operations into downstream market via construction of a lithium chemical plant. The recent mineral resource estimate for Mibra (published in April 2017 and prepared in accordance with National Instrument 43-101 Guidelines) identified 20.3 million MT of measured and indicated resources, which includes lithium, tantalum, niobium, and tin.

Anson Resources Ltd (ASN:AU) has three projects, located in Australia and the USA. The company’s flagship asset is located in the Paradox Basin, Grand County, Utah. The project consists of 291 placer claims covering 2,334 hectares – 89 claims in which Anson holds a 10% interest and is earning up to 70% in two phases with the option to then acquire the remaining interest; and 202 claims staked by Anson. During the 1960s, numerous oil wells were drilled in the region and encountered over-pressurised brines in a unit of the Pennsylvanian Paradox Formation named the Clastic Zone 31. Most wells were not analysed for lithium, but two holes within 1km of the south end of the claims (Robert’s Well and Long Canyon No.1) were tested for lithium. These tests showed a maximum lithium value of 1,700ppm and 500ppm Li respectively, noting that the higher lithium values were reported close to the Robert’s Rupture geological formation which runs through the Project claims. In addition, bromine, boron and iodine were found to be in high concentrations.

2O5)

and 1,270ppm (BeO) respectively were intersected. Mapping and

sampling programs by Ardiden successfully confirmed historical data

and expanded the potential strike length of the previously drilled

pegmatites up to 5km, further enhancing the previously delineated

new pegmatite structures – all of which are located at or near

surface. As a result of the early exploration and mapping success,

Ardiden significantly expanded the Seymour Lake Project from the

original five claims area totalling 923 Ha in two expansion phases.

The Company staked an additional 29 claim areas, increasing the

project area to 7,019 Ha. Due to the continued identification

of the multiple pegmatite exposures throughout Seymour Lake Project,

Ardiden expanded the land-holding south and east in the project to

cover these newly identified pegmatite structures and potential

mineralisation extensions. The new claims will allow the Ardiden

geological team to continue the mapping and exploration program. In

19 December 2016, Ardiden announced it had entered into an option

agreement with Alset Energy Corporation to acquire 100% of the

advanced Wisa

Lake Lithium Project.

The

Wisa Lake Lithium Project is located 80km east of Fort Frances, in

Ontario, Canada and only 8km north of the Minnesota/US border. The

property is connected to Highway 11 (Trans-Canada), which is located

65km north via an all-weather road that crosses the centre of the

project. The project is less than 3 hours’ drive from Thunder Bay,

a leading regional mining jurisdiction in Ontario with key local

infrastructure including a skilled mining workforce and excellent

local logistics and infrastructure. It has strong potential to

provide high quality product to supply growing North American demand

and export markets. The Wisa Lake Lithium Project consists of five

claims (1,200 hectares) and covers the historical Wisa Lake lithium

deposit which has a historical (non-JORC compliant) lithium resource

of 330,000

tonnes grading 1.15% Li2O

(Lexindin

Gold Mines Ltd., Manager’s Report, 1958; Ontario Geological

Survey, Open File Report 6285, Report of Activities 2012). In

1956, Lexindin Gold Mines Ltd. completed a total of 20 drill holes

(backpack and AQ-sized core) over a strike length of 335m and to a

depth of approximately 65m to define the Wisa Lake lithium deposit.

The most easterly hole intersected a true width of 6.4m containing

an estimated 20% of the lithium-bearing mineral spodumene suggesting

the mineralization is open at depth and to the east. It should be

noted that the historical resource estimate for the deposit was

calculated prior to CIM National Instrument 43-101 or JORC (2012)

guidelines and, as such, should only be considered from a historical

point of view and not relied upon. A qualified person has not

completed sufficient work to classify the historical estimates as

current Mineral Resources. Further exploration and drill testing

programs are required to report in accordance with JORC (2012)

guidelines. In early 2016, Alset Energy Corporation staked the

project and completed a limited exploration, mapping and sampling

program at the two mineralisation zones at the Wisa Lake lithium

project. The grab samples collected from the North Zone pegmatite

returned grades of up to 1.4% Li20,

which are comparable to the grade of the non-JORC compliant

historical resource of 330,000 tonnes grading 1.15% Li2O.

Grab samples were collected in the South Zone pegmatite, located

900m south and parallel to the North Zone pegmatite, which returned

grades of up to a very impressive 6.38%

Li2O.

Both the North and South Zone pegmatites were drilled in the 1950s

but very little work has been completed since then. Alset Energy

Corporation has collected and submitted approximately 60 grab

samples for assay from various pegmatites occurring on the property.

The North Zone pegmatite which was traced through surface exposures

by Alset personnel for nearly 1.5km of strike length, which contains

the non-JORC compliant resource of 330,000 tonnes grading 1.15% Li2O

and was defined by historical drilling over a strike length of 335m.

The historical drill logs show that the deposit is open to the east

and at depth and future drilling could substantially expand the

historical resource.

The

South Zone pegmatite was also drilled in the 1950s, but not to the

extent of the North Zone. This area of interest appears to have the

highest spodumene content discovered on the property, with 6.38%

Li2O

reported

from a grab sample, and will be a key focus of the company's

exploration and due diligence review.

Additionally,

Alset Energy Corporation discovered further spodumene-bearing dykes

during their April 2016 exploration program. One dyke was located

100m south of the South Zone pegmatite and a further pegmatite

exposure was mapped approximately 3kms to the West of the historic

deposit in the North Zone pegmatite. The Root

Lake Lithium Project

comprises 1,013 Ha of mining claims and has over 10,000m of historic

drilling. Mineralisation is hosted in extensive outcropping

spodumene-bearing pegmatite structures with widths up to 19m and

grades of up to 5.10% Li2O. In addition, tantalum grades of up to

380 ppm were intersected.

Assay

results from the limited maiden due diligence drilling program

conducted at Root Lake have validated the historical results,

confirming the quality and continuity of the lithium mineralisation

at the McCombe pegmatite with grades up to 3.8% Li2O

obtained and also as seen from the metallurgical drill hole

RL-16-06, which was drilled down dip for 70 continuous metres of

mineralisation, with an average grade of 1.7% Li2O.

These results support the potential for the Root Lake Project to

host multiple high quality spodumene structures. Considerable

historical exploration for lithium was undertaken in 1956 at the

McCombe pegmatite, which is located on two dikes and has been traced

at surface for a strike length of approximately 550m. Capital

Lithium Mines Ltd. completed a diamond drilling programme at the

McCombe pegmatite on the Root Lake property in 1956, consisting of

55 drill holes for 10,442m. Capital Lithium Mines Ltd. outlined a

2,333,752 tonne deposit (NB: Not JORC or NI 43-101 compliant) with a

grade of 1.3% Li2O.

This non-compliant deposit at the McCombe pegmatite covers less than

5% of the whole Project area. The McCombe pegmatite structure is

hosted in a vertically stacked series of dipping pegmatite sills.

The best exposed part of these pegmatite dikes, situated toward the

west end, has been mapped historically. Dike 1 is the largest and is

intermittently exposed for a strike length of 176m and maximum width

of 15m. Dike 2 is lens-shaped in plan and measures 19m by 87m. The

Root

Bay lithium project

is accessible via local logging roads north of Sioux Lookout and is

located approximately 300km north-west of the regional centre of

Thunder Bay. The project is strategically located approximately 5km

to the east of the recently acquired Root Lake Lithium Project and

consists of three claim areas, totalling 720 hectares. The project

was staked by Ardiden as part of its regional exploration focus in

and around the Root Bay spodumene-bearing pegmatite structure

located in Claim 4282605. The outcropping Root Bay spodumene-bearing

pegmatite structure was accidently discovered by a representative of

the Ontario Ministry of Northern Development and Mines (“MNDM”)

in 2011. The newly discovered pegmatite is exposed on the eastern

side of a logging road along the prominent ridge that follows the

presumed trace of the Lake St. Joseph Fault. The exposed pegmatite

is described as hosted by locally pillowed, mafic metavolcanic

rocks. Initial observations by the MDNM states the dyke is

characterized by coarse white albite, grey quartz and pale

grey-green spodumene crystals up to 10cm long. The outcrop

distribution of the pegmatite indicates that the spodumene dyke is

perhaps 10m wide at this location along the limited, exposed contact

of approximately 60m.

Argonaut Resources NL (ARE.AX) is an Australian Security Exchange listed mineral exploration and development company with lithium projects in Ontario, Canada and South Australia plus copper and zinc projects in South Australia, Queensland and Zambia. The Crescent Lake Lithium Project is located 250 km NNE of Thunder Bay, north of Lake Superior in Ontario, Canada. The project features two prospective areas: Falcon Lake and Zigzag. Additional claims covering the under-explored area between clusters of known spodumene pegmatites are also within the Crescent Lake Project. The Crescent Lake lithium deposits are hard rock, ‘complex-type/spodumene sub-type’ pegmatite deposits. The prospective areas are defined by two phases of drilling: historic diamond core drilling, undertaken in the 1950s; and limited modern diamond drilling completed in 2011, plus trench sampling. The pegmatites also feature elevated tantalum and are geologically comparable to the lithium tantalum pegmatite being mined at Tanco in Manitoba, Canada and Greenbushes in Western Australia. The known deposits outcrop and are potentially suitable for open-cut mining. Highlights of historic drilling at the Crescent Lake Lithium Project include: Falcon Lake has 8.1m at 1.48% Li₂O from 2.7m in drill hole W-3, 10.5m at 1.15% Li₂O from 34.5m in drill hole W-9, 14m at 0.99% Li₂O from 69.3m in drill hole CO-10-001, 7m at 1.07% Li₂O from 55.3m in drill hole CO-10-002, 11m at 1.10% Li₂O from 39.4m in drill hole CO-10-003, Zigzag has 6.1m at 1.08% Li₂O from 12.4m in drill hole CO-10-007. The Greenbush Lake Project is located approximately 150km north-west of Argonaut’s Crescent Lake Lithium Project and sits between East Pashkokogan Lake and Greenbush Lake in Ontario, Canada. The project is held via three mineral claims. The Greenbush Lake Lithium Project features a large, outcropping spodumene pegmatite with grades of up to 2.46% Li₂O within an area confirmed as having the required geological elements for spodumene pegmatite emplacement. The known spodumene pegmatite occurrence is 15m wide by 30m in exposed strike length. The actual strike length of the known pegmatite has not yet been determined as the exposure continues under sedimentary cover to the north and under lake waters to the south. The pegmatite has not been drilled. The property is yet to be explored by modern, systematic means. Economic concentrations of lithium in brine occur in circumstances where ground waters percolate through neighbouring lithium bearing rocks into a closed, continental basin that has not been subject to marine flooding throughout its geological history. Economic concentrations of lithium in brine occur in circumstances where ground waters percolate through neighbouring lithium bearing rocks into a closed, continental basin that has not been subject to marine flooding throughout its geological history. An arc of lakes, including Lake Blanche, to the north of South Australia’s Flinders Ranges has been independently defined as prospective by Geoscience Australia in a 2013 report titled ‘A Review of Australian Salt Lakes and Assessment of their Potential for Strategic Resources’. Argonaut, having assessed the potential of each lake on merit, determined that Lake Blanche has the best potential for economic lithium grades. In the event economic concentrations of lithium are contained in Lake Blanche’s brines, the lake has the potential to be an internationally significant source. No previous lithium brine exploration has been recorded in the Lake Blanche area although historic brine exploration has been undertaken at Lake Frome, to the south-east.

Argosy Minerals (ASX:AGY) is an Australian company with interests in the Rincon, Mina Teresa and Pocitos Lithium Projects in Argentina and the Erongo Project in Namibia. It is on schedule to produce lithium carbonate equivalent (LCE) from its Rincon Lithium JV Project in the Salta Province of Argentina. Recent works at the project have involved progressing with obtaining regulatory permits and approvals to commence the additional pond construction and exploration drilling works.

Ariana Resources plc (AAU.L) identifies and develops mineral resources, joint venturing its projects with experienced partners to advance them cost-effectively towards production. Asgard Metals Pty. Ltd. is an 100%-owned Australian subsidiary of Ariana, which was established by Ariana to focus specifically on technology-commodity opportunities. Asgard is focused on commodities used for renewable energy applications such as lithium and antimony. Asgard has interests in a lithium pegmatite project in the Pilbara region of western Australia in the vicinity of the Pilgangoora Project held separately by Pilbara Minerals Limited and Altura Mining Limited, which has itself been confirmed to contain the world's second largest hard-rock lithium resource in the world. In the past 12 months Asgard has completed two major deals to vend its licences to Dakota Minerals Ltd and Kingston Resources Ltd respectively. In addition the Company has signed a Memorandum of Understanding with Metal Tiger plc for the review, exploration and development of lithium-tantalum opportunities in the Malay Peninsula, and specifically within Thailand and Myanmar. The first deal was made in December 2015 with Dakota Minerals Limited (ASX:DKO). Asgard vended its licences at Pilgangoora to in exchange for A$147,000 in cash and 22,500,000 shares. Additional performance shares are to be issued in the event the project achieves specific milestones and Asgard will separately provide 12 months of consulting input to Dakota in exchange for a fixed fee payment of A$98,000 during 2016. The second transaction was a JV agreement to vend a package of tenements in Western Australia and the Northern Territory to Kingston Resources Limited as part of a broader deal involving Slipstream Resources Group. This package of tenements contains potential for lithium-tantalum bearing pegmatitic mineralisation in four areas in Western Australia and the Northern Territory.

American Lithium Corp. (LI:CN) is actively engaged in the acquisition, exploration and development of lithium deposits within mining-friendly jurisdictions throughout the Americas. American Lithium holds options to acquire Nevada lithium brine claims totalling 20,790 acres (8,413 hectares), including 18,552 acres (7,508 hectares) in Fish Lake Valley, Esmeralda County, and the 2,240 acre (907 hectare) San Emidio Project in Washoe County. The Company’s Fish Lake Valley lithium brine properties are located approximately 38 kilometers from Albemarle's Silver Peak, the largest lithium operation in the U.S. The highest grouping of assay values, 55 samples from the center of the North Playa, contains concentrations averaging 160 mg/L and a range of 100 ml/L to 300 mg/L

American Lithium Minerals, Inc. (AMLM) is an exploration-stage company. It is focused on the development of lithium and boron resources in Nevada. American Lithium has three lithium brine projects in the >Great Basin of Nevada>. The projects are located in the basins of Sarcobatus Deep, >Teels Marsh Deep and Fish Lake Deep>. The Company’s primary asset is the >Borate Hills >property in western Nevada, which covers an area of over 3,400 acres. The Borate Hills property features a deposit of 2750 parts per million of lithium (0.275%) and 1% boron. On January 5, 2010, the Company entered into an agreement with Gold Summit Corporation to acquire a 100% interest in five grass roots exploration brine projects mineral claims located in Nevada, the United States. On January 11, 2010, it entered into a property acquisition agreement to acquire a 100% interest in mineral claims located in Nevada, the United States, and to acquire a 100% interest in mineral claims located in Utah. On June 10, 2010, the Company entered into a property option agreement with >Japan Oil, Gas and Metals National Corporation (JOGMEC), whereby JOGMEC can earn a 40% participating interest in certain mineral claims located in Nevada, which is owned by the Company. In 2012 American Lithium Minerals Inc. entered into a binding Letter of Intent with Trivest Pty. Ltd. for the purchase by Trivest of 100% of their 60% interest in the North and South Borate Hills Property. American Lithium’s interest in the property was subject to a Memorandum of Understanding dated June 10, 2010 with Japan Oil, Gas and Metals National Corporation whereby Japan Oil may earn a 40% participating interest in the property for $4,000,000 cash or in kind contribution to be invested directly in the North and South Borate Project through 2013.

American Potash Corporation (APCOF) have been exploring for and developing Lithium and Potash resources in the Paradox Basin, SE Utah (UT) and SW Colorado (CO), USA for over eight years. Total Lithium + Potash exploration/development rights holdings in UT and CO of approximately 52,160 acres. American Potash control large Potash and Lithium exploration/development rights holdings covering over 40,000 combined acres in Utah Paradox Basin, SE UT. American Potash is the only explorer in the Paradox Basin with significant exploration and development rights to both Potash (K) and Lithium (Li), with about 13,200 acres of overlapping Lithium + Potash + Bromine (Br) rights in UT. American Potash recently (March, 2017) acquired 608 Federal Lithium (+ Br) placer claims covering 12,160 acres in the Colorado Paradox Basin, SW CO.

AMG (Advanced Metallurgical Group NV) (AMG:NA) is entering the lithium market with an investment of approximately $50 million in the construction of a lithium concentrate (also known as spodumene) plant at its existing Mibra mine in Brazil. Leveraging its existing mining infrastructure in place at Mibra (which has been in operation for almost 40 years), AMG’s goal is to be the low-cost producer of lithium concentrate globally. AMG can recover lithium-bearing materials from the existing and future tailings at its profitable tantalum operations at Mibra, with the ore extraction and crushing costs absorbed by the yantalum operations. AMG has successfully operated a lithium pilot plant since 2010, with more than 2.8 million tons of spodumene feed stock having been extracted. AMG has successfully operated a lithium pilot plant since 2010, with more than 2.8 million tons of spodumene feed stock having been extracted. Phase I of the project involves the construction of a lithium concentrate plant to produce 90,000 MT of spodumene per year, with operations expected to commence in the first half of 2018. Phase II would entail increasing the annual production of spodumene from 90,000 MT to 180,000 MT per year. Phase 3 of the project would see AMG expand its operations into downstream market via construction of a lithium chemical plant. The recent mineral resource estimate for Mibra (published in April 2017 and prepared in accordance with National Instrument 43-101 Guidelines) identified 20.3 million MT of measured and indicated resources, which includes lithium, tantalum, niobium, and tin.

Anson Resources Ltd (ASN:AU) has three projects, located in Australia and the USA. The company’s flagship asset is located in the Paradox Basin, Grand County, Utah. The project consists of 291 placer claims covering 2,334 hectares – 89 claims in which Anson holds a 10% interest and is earning up to 70% in two phases with the option to then acquire the remaining interest; and 202 claims staked by Anson. During the 1960s, numerous oil wells were drilled in the region and encountered over-pressurised brines in a unit of the Pennsylvanian Paradox Formation named the Clastic Zone 31. Most wells were not analysed for lithium, but two holes within 1km of the south end of the claims (Robert’s Well and Long Canyon No.1) were tested for lithium. These tests showed a maximum lithium value of 1,700ppm and 500ppm Li respectively, noting that the higher lithium values were reported close to the Robert’s Rupture geological formation which runs through the Project claims. In addition, bromine, boron and iodine were found to be in high concentrations.

Argentina

Lithium & Energy Corp(TSXV:LIT) is

targeting high-quality lithium projects in Argentina for acquisition

and development with a focus on supplying the lithium-ion battery

market. The company has the option to earn a 100-percent interest in

the Arizaro Lithium Project, located in the mining-friendly province

of Salta—in the heart of South America’s prolific Lithium

Triangle. Argentina Lithium is led by a team of experts experienced

in the full-cycle of a lithium project from exploration and

development through to processing and recovery. Dr. Daniel Galli,

Director of Technical Operations, is a widely-recognized leader in

Argentina’s lithium industry and was the driving force behind the

development of processes for the production of lithium carbonate and

battery grade lithium hydroxide from brines. Dr. Galli was

instrumental in bringing the Rincon Lithium Project into production

in Argentina. Argentina Lithium’s board of directors benefits from

the knowledge and experience of members such as Nicolas Galli and

Joseph Grosso. Galli has contributed to the development and

construction of important lithium projects in Argentina including

Orocobre, Enirgi and FMC. Mr. Grosso, one of the early pioneers of

the mining sector in Argentina, is the Founder of The Grosso Group,

which has a storied career in Argentina’s resource sector with a

track record of success that includes three world-class precious

metals discoveries. The

company provided

an update on exploration programs on its two active lithium

exploration projects at the Arizaro and Incahuasi salars located in

the Lithium Triangle in Argentina. Due to an increase in activities,

a new Project Manager is being hired to manage exploration moving

forward. The Company has recently expanded the property holdings at

the Arizaro project in Salta province by an additional 7,030 ha.

Geophysical and seismic surveying is the next step prior to a Phase

II drill program to test for deep brines. At the new

wholly-owned Incahuasi project in Catamarca province, the Company

plans to move directly into a first drill program, and is now in the

process of obtaining permits to do so. The Company recently

announced the acquisition of the property which controls the entire

salar as well as initial surface sampling and VES geophysical

results. The results included samples of 409 mg/l Lithium at

surface. It is expected that the two properties will see up to

10,000 metres of drilling collectively.

Argonaut Resources NL (ARE.AX) is an Australian Security Exchange listed mineral exploration and development company with lithium projects in Ontario, Canada and South Australia plus copper and zinc projects in South Australia, Queensland and Zambia. The Crescent Lake Lithium Project is located 250 km NNE of Thunder Bay, north of Lake Superior in Ontario, Canada. The project features two prospective areas: Falcon Lake and Zigzag. Additional claims covering the under-explored area between clusters of known spodumene pegmatites are also within the Crescent Lake Project. The Crescent Lake lithium deposits are hard rock, ‘complex-type/spodumene sub-type’ pegmatite deposits. The prospective areas are defined by two phases of drilling: historic diamond core drilling, undertaken in the 1950s; and limited modern diamond drilling completed in 2011, plus trench sampling. The pegmatites also feature elevated tantalum and are geologically comparable to the lithium tantalum pegmatite being mined at Tanco in Manitoba, Canada and Greenbushes in Western Australia. The known deposits outcrop and are potentially suitable for open-cut mining. Highlights of historic drilling at the Crescent Lake Lithium Project include: Falcon Lake has 8.1m at 1.48% Li₂O from 2.7m in drill hole W-3, 10.5m at 1.15% Li₂O from 34.5m in drill hole W-9, 14m at 0.99% Li₂O from 69.3m in drill hole CO-10-001, 7m at 1.07% Li₂O from 55.3m in drill hole CO-10-002, 11m at 1.10% Li₂O from 39.4m in drill hole CO-10-003, Zigzag has 6.1m at 1.08% Li₂O from 12.4m in drill hole CO-10-007. The Greenbush Lake Project is located approximately 150km north-west of Argonaut’s Crescent Lake Lithium Project and sits between East Pashkokogan Lake and Greenbush Lake in Ontario, Canada. The project is held via three mineral claims. The Greenbush Lake Lithium Project features a large, outcropping spodumene pegmatite with grades of up to 2.46% Li₂O within an area confirmed as having the required geological elements for spodumene pegmatite emplacement. The known spodumene pegmatite occurrence is 15m wide by 30m in exposed strike length. The actual strike length of the known pegmatite has not yet been determined as the exposure continues under sedimentary cover to the north and under lake waters to the south. The pegmatite has not been drilled. The property is yet to be explored by modern, systematic means. Economic concentrations of lithium in brine occur in circumstances where ground waters percolate through neighbouring lithium bearing rocks into a closed, continental basin that has not been subject to marine flooding throughout its geological history. Economic concentrations of lithium in brine occur in circumstances where ground waters percolate through neighbouring lithium bearing rocks into a closed, continental basin that has not been subject to marine flooding throughout its geological history. An arc of lakes, including Lake Blanche, to the north of South Australia’s Flinders Ranges has been independently defined as prospective by Geoscience Australia in a 2013 report titled ‘A Review of Australian Salt Lakes and Assessment of their Potential for Strategic Resources’. Argonaut, having assessed the potential of each lake on merit, determined that Lake Blanche has the best potential for economic lithium grades. In the event economic concentrations of lithium are contained in Lake Blanche’s brines, the lake has the potential to be an internationally significant source. No previous lithium brine exploration has been recorded in the Lake Blanche area although historic brine exploration has been undertaken at Lake Frome, to the south-east.

Argosy Minerals (ASX:AGY) is an Australian company with interests in the Rincon, Mina Teresa and Pocitos Lithium Projects in Argentina and the Erongo Project in Namibia. It is on schedule to produce lithium carbonate equivalent (LCE) from its Rincon Lithium JV Project in the Salta Province of Argentina. Recent works at the project have involved progressing with obtaining regulatory permits and approvals to commence the additional pond construction and exploration drilling works.

Ariana Resources plc (AAU.L) identifies and develops mineral resources, joint venturing its projects with experienced partners to advance them cost-effectively towards production. Asgard Metals Pty. Ltd. is an 100%-owned Australian subsidiary of Ariana, which was established by Ariana to focus specifically on technology-commodity opportunities. Asgard is focused on commodities used for renewable energy applications such as lithium and antimony. Asgard has interests in a lithium pegmatite project in the Pilbara region of western Australia in the vicinity of the Pilgangoora Project held separately by Pilbara Minerals Limited and Altura Mining Limited, which has itself been confirmed to contain the world's second largest hard-rock lithium resource in the world. In the past 12 months Asgard has completed two major deals to vend its licences to Dakota Minerals Ltd and Kingston Resources Ltd respectively. In addition the Company has signed a Memorandum of Understanding with Metal Tiger plc for the review, exploration and development of lithium-tantalum opportunities in the Malay Peninsula, and specifically within Thailand and Myanmar. The first deal was made in December 2015 with Dakota Minerals Limited (ASX:DKO). Asgard vended its licences at Pilgangoora to in exchange for A$147,000 in cash and 22,500,000 shares. Additional performance shares are to be issued in the event the project achieves specific milestones and Asgard will separately provide 12 months of consulting input to Dakota in exchange for a fixed fee payment of A$98,000 during 2016. The second transaction was a JV agreement to vend a package of tenements in Western Australia and the Northern Territory to Kingston Resources Limited as part of a broader deal involving Slipstream Resources Group. This package of tenements contains potential for lithium-tantalum bearing pegmatitic mineralisation in four areas in Western Australia and the Northern Territory.

Ashburton

Ventures Inc. (ABR.V)

is

a Canadian-based junior exploration with active mineral programs in

Canada

and

Nevada,

USA. It announced

that it had received assay results from its recent work program on

the 100% owned Elon claims located in Clayton

Valley,

Nevada. The property is directly beside Pure’s discovery and right

beside the CV-6 hole recently completed by Pure. Lithium-X has also

acquired a large land package directly to the west to now completely

enclose the property in between them and Pure. Eleven samples were

submitted to ALS Minerals in Reno, Nevada and all have come back

with positive lithium numbers. The program consisted of surface

sediment sampling from various locations across the property. The

samples were crushed, split, a portion was pulverized and a one (1)

gram aliquot analyzed by ALS Chemex method ME-MS61 (48 element,

including lithium, four acid ICP-MS). The Thompson

Bros. Lithium Property is

located in Wekusko Lake, 20km east of the mining community of Snow

Lake, Manitoba. The main highway to Thompson and Flin Flon, plus the

railway to the Winnipeg and the seaport of Churchill passes 40 km

south of the property. The property consists of 18 contiguous claims

covering 1829 hectares. The lithium deposit is a spodumene rich

pegmatite dike with a near vertical dip and a strike length of over

800 meters. The dike was originally drilled in 1956 by Combined

Developments Limited, with three additional holes drilled by Carta

Resources Limited in 1997; for a total of 30 drill holes. A resource

calculation made by B. Ainsworth, P. Eng. in 1998, resulted in an

"undiluted drill indicated mineral resource" of 3,968,000

tonnes with a weighted average value grade of 1.29% Li2O

to the 130 meter level, and an average width of 10 meters. A further

337,000 tonnes is indicated by the deepest hole (D.H. Car-97-2), to

the 380 m level, which is over 200 meters from the nearest hole, and

which cut a horizontal width of 8 m of 1.3% Li2O.

Thus, Ainsworth suggests a total drill indicated and possible total

resource calculation of 4,305,000 tonnes of 1.3% Li2O

for the deposit (NON 43-101 Compliant), open to depth and along

strike. The 1998 resource calculation is historical and not National

Instrument 43-101 compliant as it was completed prior to the

implementation of these requirements, and thus cannot be relied

upon. A metallurgical evaluation of the spodumene deposit by Dr. W.

Dressler of Laurentian University indicated that simple floatation

would recover 92% of the spodumene and produce a concentrate grading

6.6% Li2O

or 89.2% spodumene. Carta Resources completed a business plan to

develop the Thompson Bros. Lithium Deposit for the production of

lithium carbonate, but a decline in lithium carbonate prices stalled

the project in 1998.

Avalon

Advanced Materials Inc

(AVL.TO)

is a Canadian mineral

development company with a primary focus on the rare metals and

minerals. Avalon’s Separation

Rapids Lithium Project has the

potential to produce high purity lithium compounds for two distinct

markets: an industrial mineral product for glass-ceramics and a

lithium chemical for energy storage. Since acquiring the property in

1996, Avalon has expended approximately $10 million on exploration

and development work, primarily focused on the deposit’s lithium

potential. Initial exploration work conducted in 1997-2001 included

geological mapping, trenching, ground magnetic surveys,

mineralogical studies and diamond drilling totalling 10,152 m in 69

holes. Subsequent work focused on tantalum potential and other

potential industrial mineral products. Measured and Indicated

Mineral Resources, as currently delineated, total 8.0 million tonnes

averaging 1.29% lithium oxide and 39% feldspar. Inferred Mineral

Resources contribute an additional 1.63 million tonnes at 1.42%

lithium oxide and 39% feldspar to a maximum vertical depth of 260

metres. The deposit is open in depth and along strike. Recent test

work conducted by Lepidico Ltd. of Perth, Australia, using its

patented L-Max® hydrometallurgical process technology, has

successfully produced a battery grade lithium carbonate product from

lepidolite

sourced from the Separation

Rapids property - another lithium mineral Avalon is currently

quantifying.

Avarone

Metals (AVM:CSE

|

W2U1:FRA)

has entered into an agreement with an arms' length vendor to acquire

a 100% interest in the Moab

Lithium Project,

which covers an area of 3200 acres of placer claims in the Big

Smoky Valley, Nevada,

directly adjacent to claims controlled by Ultra Lithium. Esmeralda

County Nevada has seen resurgence in exploration activity,

culminating with Pure Energy's identification of a NI 43-101

inferred resource of 816,000 metric tonnes of lithium carbonate

equivalent (LCE)* at a cut-off of 20mg/L in brine. (*Technical

Report (2015) Spanjers, MS. PG.) The primary target at the Moab

Lithium Project is a horseshoe shaped gravity low anomaly that has

been interpreted as an in filled basin. Exploration of the Big Smoky

Valley by the USGS in the 1970's culminated in the drilling of two

Reverse Circulation holes, both of which encountered anomalous

concentrations of lithium that were highly similar to those

encountered in the Clayton Valley, just to the south, and where the

Silver Peak Mine is located. Hole BS-13, which is located just 2.4

kilometers east of the Moab project border was designed to test the

same basin covered by the Moab Project and Ultra Lithium's Big Smoky

Valley Project. Hole BS-13 was terminated at 200 m, and geochemical

analysis revealed lithium in sediments ranging from 48ppm to 365ppm

and averaging 160ppm. This is considered significant, as the cut-off

grade used by Pure Energy for their resource calculation is only

20ppm.

AVZ

Minerals Ltd

(AVZ:AU)holds

interests in exploration projects prospective for lithium, tin,

tantalum and associated minerals located in the Democratic Republic

of Congo, including a 60% interest in the

Manono

Project

a lithium-rich pegmatite deposit, 100% interest in the surrounding

Manono

Extension Project

(lithium, tin, tantalum) and the Katanga

Regional Project

(lithium, base metals and rare earths). The Manono Project is owned

by AVZ

(60%), La Congolaise D’exploitation Miniere SA (30%) (Cominiere, a

State-owned enterprise) and Dathomir Mining Ressources SARL (10%)

(Dathomir, a privately owned company). The presence of lithium

mineralisation in pegmatites at Manono has been confirmed to extend

along strike of for more than 13km. Two large areas of pegmatite

have been identified, with the northeast area, referred to as the

Manono sector and the south-west area, referred to as the Kitotolo

sector. Mapping within the two sectors has established that there

are many pegmatites, representing separate intrusions, including six

large pegmatites. The large pegmatites all contain spodumene

mineralisation. The majority of the smaller pegmatites also contain

spodumene and in some cases other lithium minerals. The two largest

pegmatites (known as the Carriere de L’est Pegmatite and the Roche

Dure Pegmatite) are each of similar size or larger than the

Greenbushes Pegmatite in Western Australia. The thickness of the

Roche Dure Pegmatite currently being drill tested is estimated to be

at least 240 metres. Spodumene ranging between 5% to 25% of whole

rock volume and minor cassiterite/coltan is clearly visible in

sections of the core. The estimated base of weathering ranges

between approximately 30 to 60 metres below surface with a short

transitional zone and then fresh (unweathered) pegmatite below to a

depth of at least 240 metres. AVZ’s current activities at Manono

comprise mapping, surface trenching and diamond drilling. Recent

results have confirmed high-grade lithium mineralisation over a

strike length of four kilometres, with highlights including: 45.74

metres at 1.59% lithium from 50.5 metres at The Mpete pegmatite; and

65.86 metres at 1.51% lithium from 167 metres at the Tempete

pegmatite. Assays have been received for five holes of the initial

seven-hole drill program at the Manono project, which covers circa

188 square kilometres.The Manono Extension Project comprises two

granted exploration permits (PRs 4029 and 4030) covering 242.25km2

and surround the Manono Project licence. The Katanga Regional

Project comprises seven exploration licences within the

mid-Proterozoic Kibaran Belt in the south of the Democratic Republic

of Congo known to host lithium bearing pegmatites. AVZ has reached

an agreement with Huayou

International Mining (HONGKONG)

Limited (Huayou) for Huayou to invest $13.02 million and acquire an

11% interest in AVZ. Its subsidiary Huayou Cobalt, is the largest

cobalt chemicals producer in China.

Bacanora

Minerals (TSX:BCN),

a Canadian miner developing a lithium mine in Mexico,

Sonora,

first to enter in a conditional supply agreement with Tesla

(NYSE:TSLA)

The

Sonora Lithium Project is comprised of the following lithium

properties: La Ventana lithium concession, which is 100 percent

owned by Bacanora, and the El Sauz and Fleur concessions, which are

held by Mexilit S.A. de C.V. ("Mexilit"). The Megalit

concession, which is held by Megalit S.A de C.V ("Megalit"),

is not included in the Sonora Project Technical Reports at this

time. Mexilit and Megalit are owned 70 percent by Bacanora and 30

percent by Rare Earth Minerals Plc (now Cadence

Minerals plc).

With

an Indicated Mineral Resource estimate of 4.5 million tonnes of

lithium carbonate equivalent (‘LCE’) and an Inferred Mineral

Resource of 2.7 Mt of lithium carbonate equivalent (‘LCE’),

Sonora is regarded as one of the world’s larger known clay lithium

deposits. Hanwa acquired

an initial 10% interest in Bacanora following a private placement.Bacanora

announced in November 2017 that its jointly controlled entity,

Deutsche Lithium GmbH , has been granted a mining licence covering

256.5 hectares of its Zinnwald Lithium Project which is located in

southern Saxony, Germany, close to the key German automotive and

downstream lithium chemical industries. The 30 year Licence has been

issued by the Saxony State Mining Authority (Sächsisches

Oberbergamt) in accordance with §8 of the German Mining Act

(Bundesberggesetz). Zinnwald is located in a granite hosted Sn/W/Li

belt that has been mined historically for *n, tungsten and lithium.

Recent testwork on Zinnwald concentrates has shown that a number of

downstream lithium products can be produced from the Zinnwald ores,

utilising chemicals and infrastructure available in the Dresden area.

As part of the ongoing development of Zinnwald, a Feasibility Study

is underway to develop a strategy to demonstrate the economic

viability of producing higher value downstream lithium products for

the European battery and automotive sectors and is expected to be

completed in mid-2019.

Bearing

Resources

(TSXV:BRZ),

now Bearing Lithium

Corporation, a Canadian miner

developing a lithium brine project in Chile.

Through

an agreement with Li3 Energy Inc. (OTCQB:LIEG), Bearing will acquire

an undivided 17.7% interest in the advanced-stage Maricunga

project

located in Chile.

The Maricunga lithium brine project represents one of the

highest-grade undeveloped lithium salars in the Americas. Over US$30

million has been invested in the project to date and all future

expenditures through to the delivery of a Definitive Feasibility

Study (DFS) are fully-funded by it's joint venture partners. The

Salar

de Maricunga

represents one of the highest-grade, undeveloped salars in the

Amercias second in grade only to the Salar de Atacama, which

accounts for 100% of Chile’s production or about 40% of global

production. The project is located in Region III of Atacama in

northern Chile, approximately 170 km north-east of Copiapo and

adjacent to International Highway 31. The project is host to a JORC

M&I resource of 1.7million tonnes of lithium carbonate

equivalent (“LCE”)

at a grade of 1,143 mg/L lithium (Li) plus an Inferred resource of

0.4 million tonnes of LCE at a grade of 1,289 mg/L Li. The project

is comprised of a number of tenements totalling 4,463 hectares, of

which some are grandfathered under a previous mining code which may

allow for the exploitation of lithium. Bearing

Lithium announced in September 2017 that Li3 shareholders have

overwhelmingly approved the transaction. At a shareholder vote

held,, a total of 71.9% of shares were voted at the meeting of which

99% voted in favour of the transaction. The number of Bearing

Lithium shares to be issued under the scheme will be approximately

16 million shares. Closing of the transaction is anticipated to

occur immediately. Following completion of the transaction, Bearing

Lithium will have approximately 46.5 million common shares

outstanding, with former Li3 Energy shareholders representing

approximately 34% of Bearing’s pro-forma share capital. Li3 Energy

and its subsidiaries are now wholly-owned subsidiaries of Bearing.

Bearing Lithium Corp. (TSX Venture: BRZ) (OTCQB: BRGRF) (FRANKFURT:

B6K1) announced that it had entered into an option agreement dated

September 25, 2017 with First

Division Ventures Inc.

, for First Division to acquire a 100% interest

in

certain mining claims held by Bearing located in Esmeralda County,

Nevada

First Division is a private

company located in British Columbia. The terms of the Agreement

provide that in order for First Division to exercise the Option, it

must make a cash payment in the initial amount of $20,000 and issue

20,000 common shares to Bearing within 10 days of execution, and

thereafter issue an additional 4,000,000 common shares to Bearing by

the third anniversary of the Agreement. First Division must also

carry out a $3,000,000 work program on the Claims prior to the third

anniversary of the Agreement:$120,000 within the first year,

$800,000 during the second year and $2,000,000 by the end of the

third year. Following exercise of the Option, the Bearing will

retain a 3% net smelter returns royalty. The NSR Royalty is not

subject to a buy-back or repurchase right. The Maricunga joint

venture is currently (October, 2017) working with equipment

suppliers including Veolia, GEA, Andritz and FLSmidth to undertake

pilot plant test work utilizing brine sourced from the Maricunga